A practical look at building a real-time options flow platform using WebSockets and Redis

If you’ve ever watched options flow in real time, you already know one thing: speed changes everything.

When a large options order hits the market, it’s only useful if traders see it immediately. A delay of even a few seconds can make the data irrelevant. That’s exactly the problem we set out to solve when building our options live feed flow system.

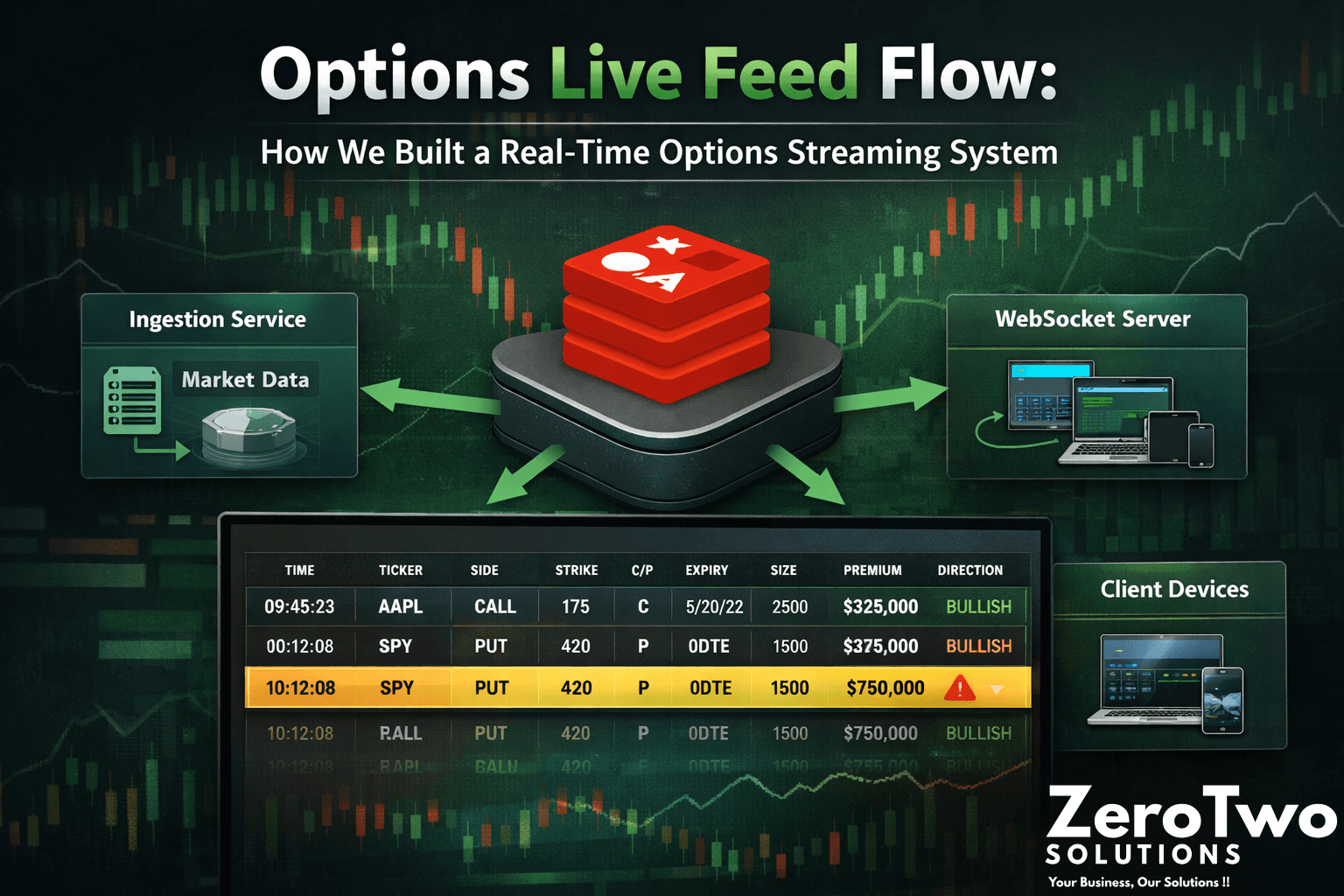

This post walks through how we designed a real-time options streaming platform using WebSockets and Redis based on what actually works in production.

1. Why Options Flow Is Different from Normal Market Data

Options flow isn’t like static option chains or historical data. It’s:

- High frequency - Event-driven - Filter-heavy - Extremely time-sensitive

Users aren’t just watching prices they’re watching behavior. Large premiums, unusual size, short-dated contracts, aggressive sweeps. All of that has to show up instantly or it loses value.

2. The First Problems We Hit

Our early versions ran into issues fast:

- Too many REST calls - Database queries on every update - Filters that slowed down under load - UI lag during peak market hours

It became clear that a traditional request–response setup just wasn’t going to survive real options traffic.

3. The Architecture We Settled On

What finally worked was keeping the live path simple:

Market data comes in → we normalize it → store it in Redis → stream it via WebSockets.

Redis became the center of everything. Not as a cache but as the primary real-time data store. The WebSocket layer only reads from Redis and pushes data to users.

4. WebSockets for Live Delivery

Each user opens a WebSocket connection when they load the flow page.

At connection time we: - Authenticate the user - Check their subscription level - Assign them to a dedicated channel group

Once connected, users don’t poll anything. They just receive updates as soon as new trades are indexed in Redis.

5. Real-Time Filtering That Actually Scales

One of the hardest parts was filtering.

Traders want to filter by: - Ticker and expiration - Call or Put - Premium size - Strike range - Volume, size, DTE, OTM% - Special trade flags

We moved all of this filtering into Redis Search. That decision changed everything.

Instead of hitting a database, we run in-memory searches sorted by timestamp. Even complex filters return fast, and performance stays stable during market spikes.

6. Why Redis Worked So Well Here

Redis turned out to be a perfect fit because:

- Reads and writes are extremely fast - Data lives entirely in memory - Search queries scale cleanly - Old data can expire automatically - WebSocket servers stay stateless

The system feels responsive even when the market is chaotic.

7. What the User Actually Sees

On the frontend, users see a live table that updates continuously:

- New trades appear instantly - Large premiums get flagged - Directional trades stand out - No page refreshes - No loading spinners

It feels closer to a professional trading terminal than a typical web app which was the goal.

8. Handling Alerts and Unusual Activity

We also enrich trades in real time.

For example: - Flag unusually large premiums on specific symbols - Highlight aggressive trades - Mark special conditions when thresholds are crossed

This helps traders focus on signal instead of noise.

9. Keeping Latency Low During Market Hours

A few rules made a big difference:

- Never query SQL in the live path - Keep WebSocket payloads small - Batch results instead of sending one trade at a time - Let Redis handle the heavy lifting

Following these rules kept the feed smooth even during the busiest sessions.

10. Scaling Without Overengineering

Scaling ended up being straightforward:

- Add more WebSocket servers - Redis handles concurrent searches - Users are isolated by channels - Historical data lives elsewhere

No complicated orchestration, no fragile dependencies.

Final Thoughts

Building an options live feed isn’t about flashy tech it’s about respecting how fast markets move.

By leaning on Redis for real-time querying and WebSockets for delivery, we built a system that stays fast, stable, and predictable when it matters most.

We now use this same approach for options flow analytics, real-time market monitoring, and trading dashboards in production every day.

Need help building something similar?

If you’re working on a real-time market data or trading platform and want to avoid the mistakes we already made, we’re happy to help.

Sometimes the difference between a usable product and a great one is just a few milliseconds.